Trim the busywork.

Let payments run themselves

SwipeSimple gives your landscaping business the tools to keep growing. Take payments however and wherever you work – set up service subscriptions, send polished invoices, or process payments on-site with your mobile device and tablet.

Your invoices and payments on autopilot

Why landscaping companies need SwipeSimple

You need a payment solution built for outdoor service – with features that make getting started, well, simple. Our flat rate pricing for card present and card not present transactions means you're never surprised by hidden fees.

Transparent pricing, always

2.6% + 10¢ per in-person transaction, or 3.5% + 10¢ for virtual and over-the-phone transactions.

Or offset your fees entirely with SwipeSimple Connect Zero

Invoices, recurring payments, and more

From one-time jobs to monthly contracts, SwipeSimple handles payment collection so you don’t have to.

Accept card payments when needed

Keyed, Tap to Pay on iPhone, swipe, insert, and tap — all supported.

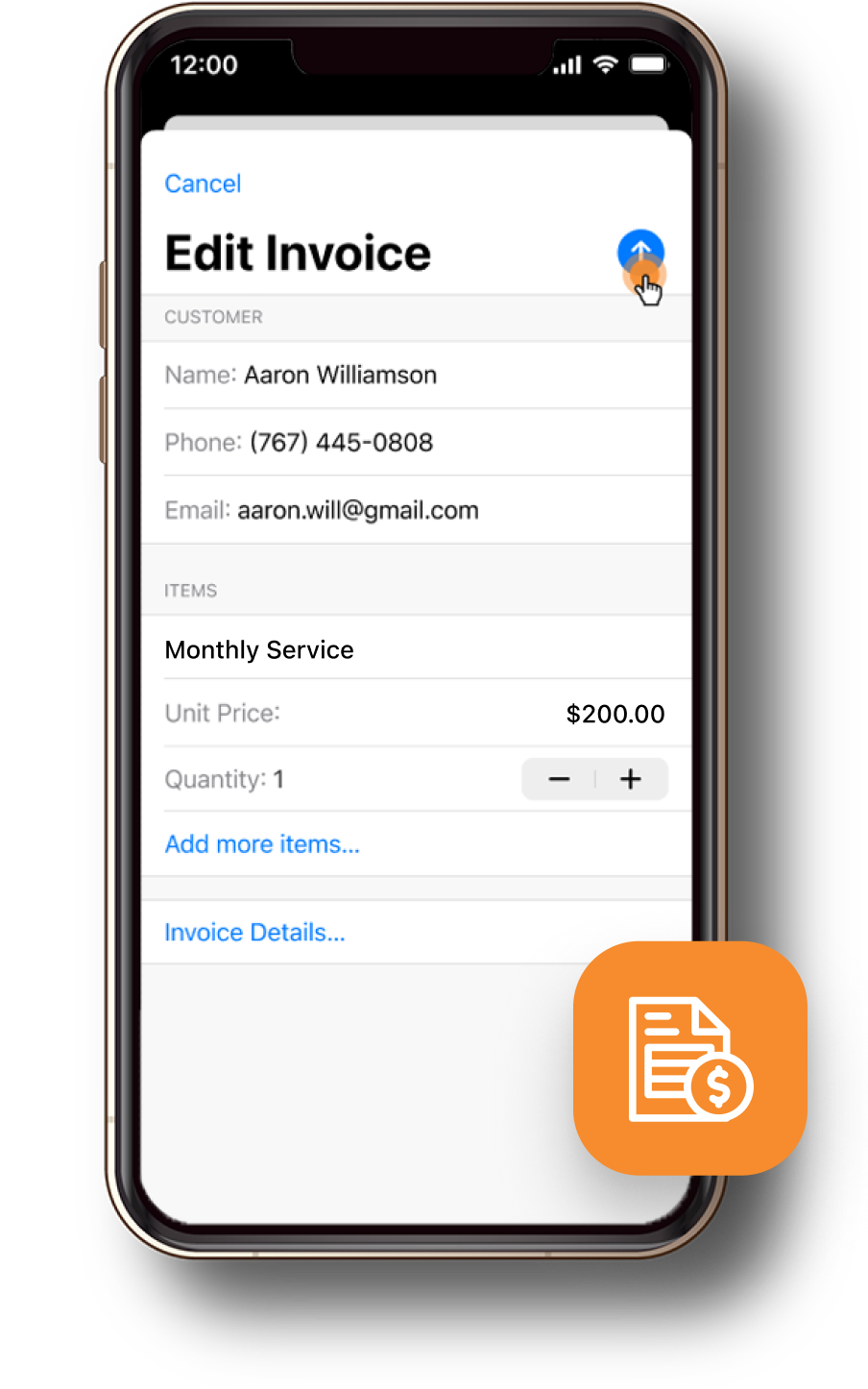

Custom itemization and design

Created and stored line items and pricing unique to your business, finished with logo and notes for each job.

Support that knows your business

Real people, U.S.-based.

Run your business all in one tool

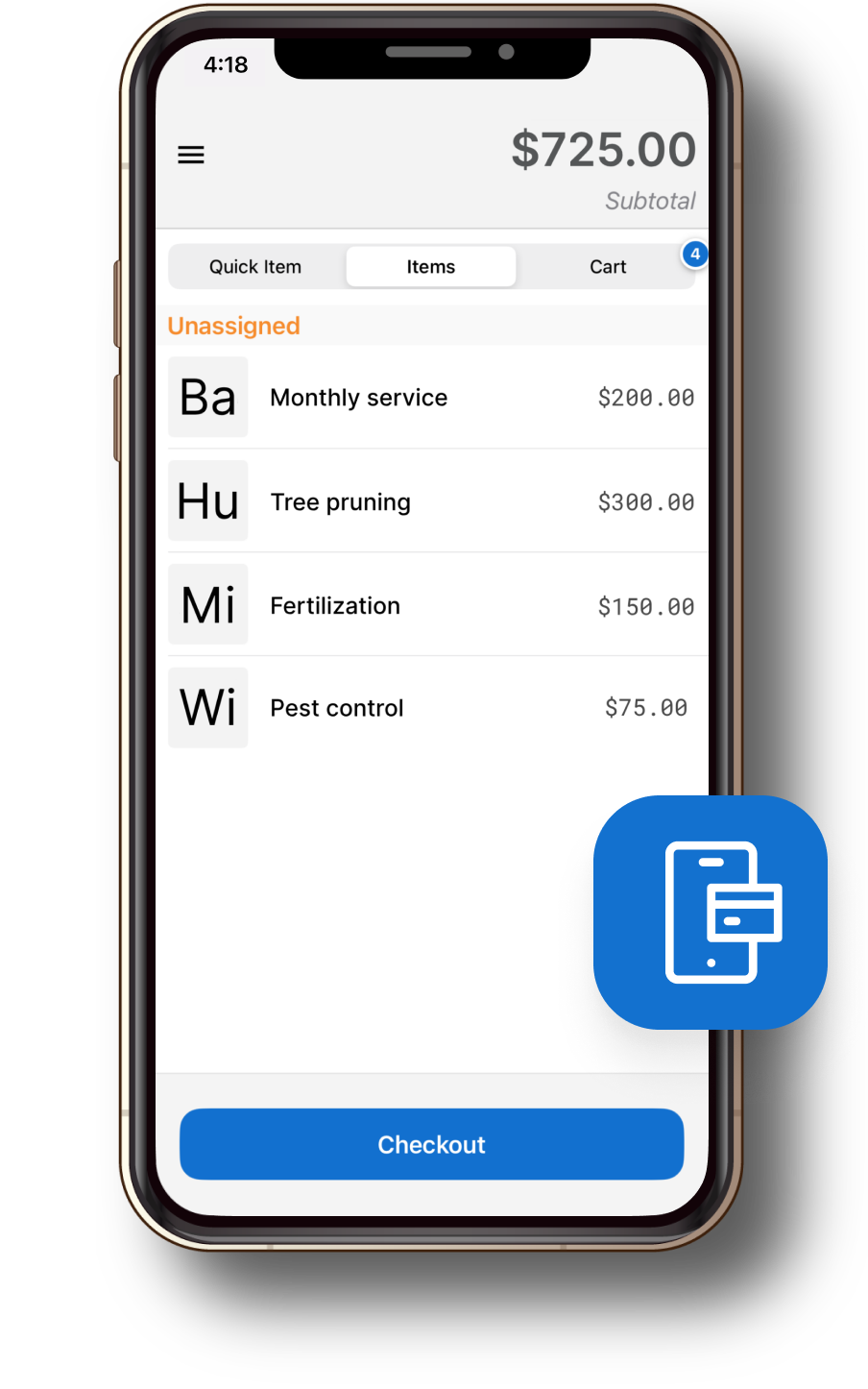

Mobile app

Access your invoices, transaction history, or item catalog directly on your mobile phone or tablet and make changes right from your jobsite.

Full-feature invoicing

Send branded invoices you build quickly using stored line items for common services, discounts, and tax rates, then send by email or SMS.

Automatic payment reminders

Let your payment collections run themselves with automatic reminders set at the account level – no need to configure for each invoice.

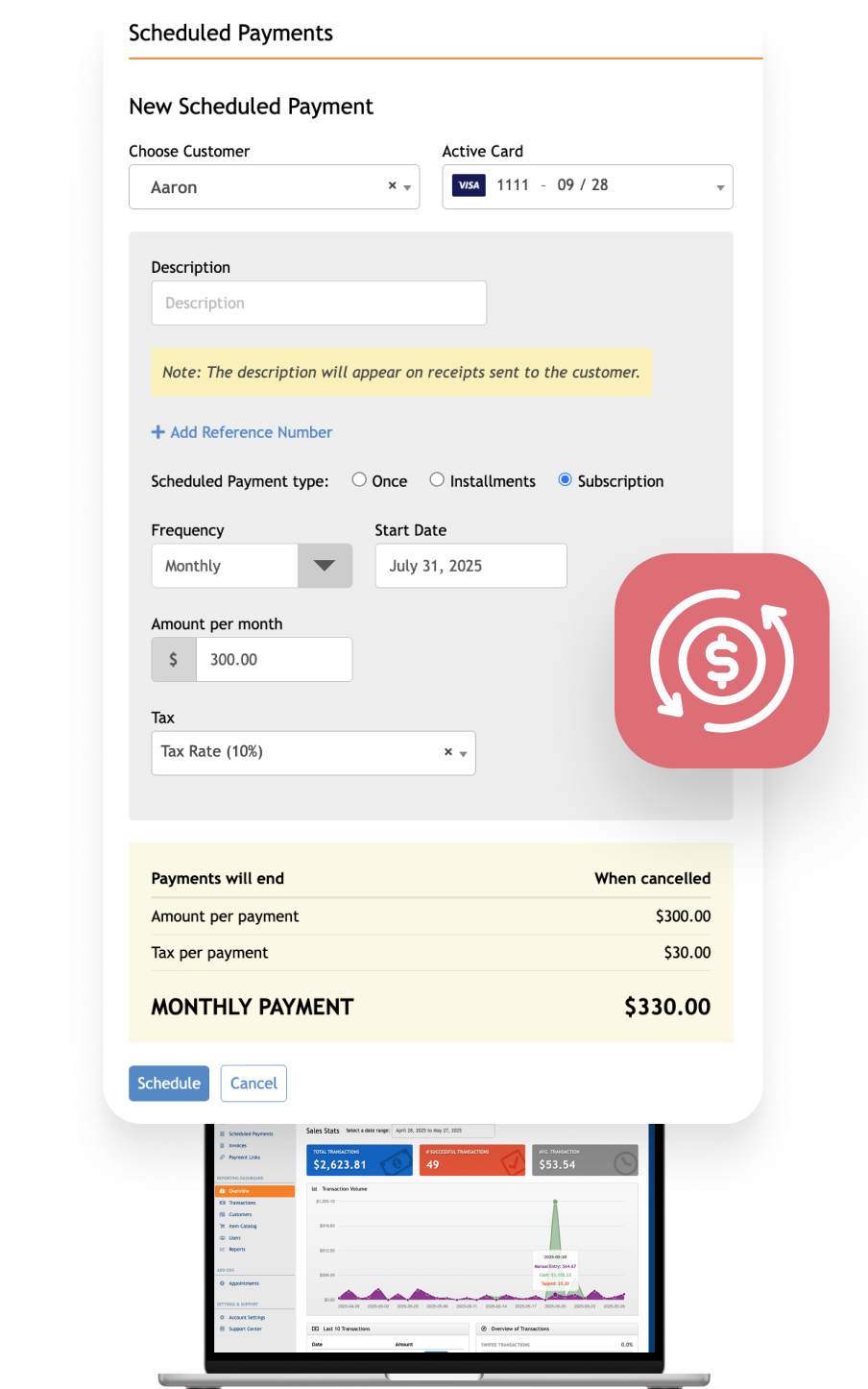

Recurring payments

Store customer cards securely and schedule payments on your chosen cadence; so you never chase invoices for residential lawn care or commercial contracts.

See it in action

Mobile app demo

A full point of sale system for your business – right at your fingertips.

Desktop demo

From customer information to transaction history and reports.

Get started with SwipeSimple Connect today.

Keep more of what you earn on every transaction with SwipeSimple Connect.

Contact Sales (332) 242-3541 or email sales@swipesimple.com

More to explore

Simple pricing

SwipeSimple Connect pricing is simple.

You only pay for SwipeSimple Connect processing when you use it.

- 2.6% and 10¢ per transaction when you tap, dip, or swipe a customer’s card or contactless payment device (known as Card-Present transactions)

- 3.5% and 10¢ per transaction when you manually key in your customer’s card details, use a card on file, when a customer pays via invoice, payment link, or makes an online purchase (known as Card-Not-Present transactions)

Once approved, you can begin to accept payments through the SwipeSimple mobile application or website using a mobile device or computer you already own. To be able to tap, dip, or swipe a card, you can also purchase a:

- Bluetooth card reader that connects with your mobile phone or tablet for $49. Tax not included.

- Smart payment terminal for $299. Tax not included.

Chargeback fee: $15

Refunded transactions:

- There are no fees to process a full or partial refund

- Fees that were charged on the original sale are not returned when the transaction is refunded

With SwipeSimple Connect, we keep things simple.

That means no long-term contracts and:

- No setup fees

- No monthly fees

- No annual fees

- No batch fees

- No statement fees

- No PCI compliance fees

When will I receive funds in my bank account?

Payment settlement typically occurs within two business days for transactions processed through your SwipeSimple Connect account.

All the support you need

It's easy to setup your business with SwipeSimple Connect. No training or technical knowledge is needed.

Whether you're accepting credit cards for the first time, or are converting to SwipeSimple Connect from another provider, it's easy to set up, get started, and get paid.

If you do need support, SwipeSimple Connect merchants have access to our world-class support team.

What information do I need to complete the application?

To quickly complete your merchant application you will need to state how your business is structured.

All business structures need to provide a Social Security Number or Tax ID Number (TIN), date of birth, and home address for each individual who owns at least 25% of the business. All business structures also need to provide the bank name, ABA Routing Number, and account number for the business bank account.

Common business structures are:

Sole Proprietorship

The business is owned by one person and tied to that person’s Social Security Number or Taxpayer ID Number.

Limited Liability Company (LLC)

The business is officially registered as a LLC and the legal business name typically includes LLC.

Private Corporation (including C and S corporations)

The business is privately owned and is registered as a C or S corporation. The legal business name typically includes Inc.

Partnership (including GP, LP and LLP)

The business has shared ownership and is either unincorporated or registered as a General Partnership, Limited Partnership, or a Limited Liability Partnership. The legal business name may include GP, LP or LLP.

Nonprofit organization

An organization or group that has been organized as a Not-For-Profit Corporation and has 501(c)(3) or other legal status as a nonprofit.

Government Entity

An entity that has been organized by a national or local government authority.

Publicly Traded Company

The business is a corporation that is publicly owned by shareholders who have ownership in the company and where shares are publicly traded on a stock exchange.

If there are no owners with at least a 25% stake in the company or if the organization is a nonprofit or governmental entity, then the person authorized to submit the application (often known as the Authorized Controller or Control Prong) will need to provide their Social Security Number, date of birth, and home address in the “Add an Owner” section.

What is SwipeSimple Connect?

SwipeSimple Connect is an all-in-one payments solution for small businesses.

As a SwipeSimple Connect merchant you will have access to the following features and services.

SwipeSimple

- The easy-to-use payment solutions software currently used by more than 125,000 small businesses across the US

- Software designed to work on the standard computer and mobile device which you may already own

Merchant processing account with simple pricing

You only pay for the processing when you use it.

- 2.6% + 10¢ per transaction when you tap, dip, or swipe a customer’s card or contactless payment device (known as Card-Present transactions)

- 3.5% + 10¢ per transaction when you manually key in your customer’s card, use a card on file, when a customer pays via invoice or payment link, or makes an online purchase (known as Card-Not-Present transactions)

Hardware devices to expand how you accept payments

- Bluetooth card reader to pair with your iPhone, iPad, or Android phone or tablet for $49 plus tax

- Smart terminal to take payments and print receipts with an all-in-one device for $299 plus tax

Personalized training and support

- Our team helps you get started through personalized setup and training

- The SwipeSimple Support Team is available to help by email and phone

Get started on your SwipeSimple Connect application.

SwipeSimple Connect is provided and supported by CardFlight, the developers of SwipeSimple software. SwipeSimple is also sold through a network of merchant acquirers, regional resellers, and financial institutions. Learn more about our SwipeSimple partners.